Return Inwards Debit or Credit

The part -3 of annual return consist of all input tax credit availed and reversed in the financial year for which the annual return is filed. Sales returns Return inwards Total sales returns from the Return Inwards Day book Sales returns journal.

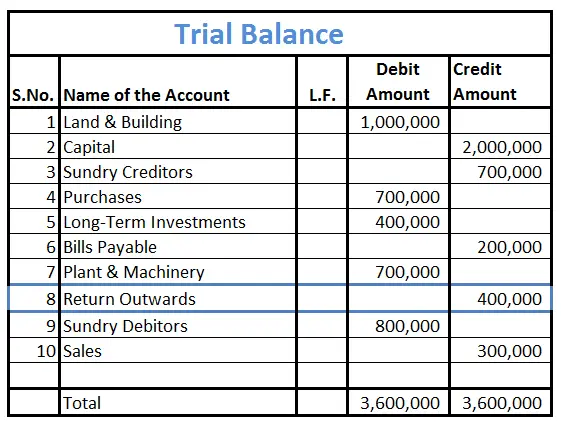

How Is Return Outwards Treated In Trial Balance Accounting Capital

As per the mandate from Central Bank of the UAE cheque books issued during the first 6 months of opening the account could be limited to 10 leaves depending on the Individuals rating with the credit bureau AECB.

. For information about making a return or exchange please visit our Returns Exchanges page. From the cash column on the debit side of the Cash Book. In this case the liability of tax payment is transferred to the recipientreceiver instead of the supplier.

To pay by cash place cash on top of the delivery box and step back. Journal Entry for a Sales Return. It is estimated that over 70 of the population suffer from rolling inwards of the foot and fallen arches ie.

Read more becomes a debit Debit. A ledger is the actual account head to identify your transactions and are used in all accounting vouchers. Debit The goods are returned and the asset of inventory increases.

It is a sales return and on. Thus matching of the trial balance is a Thing of Past and the traditional need for someone to depend on trial. A debit note also known as a debit memo is a document sent by the seller to the buyer informing about the current debt obligations or it may be a document sent by the buyer to the seller at the time of returning goods as proof return outwards.

The shift in strategy of the two banks tracks the arc of globalization. Accounting software like TallyPrime is designed to ensure that debit and credit always match at the time of recording the transaction itself. The entries about the Freight inwards are posted on the debit side of the trading account whereas the entries about the carriage outwards are posted on the credit side of an income statement Income Statement The income statement is one of the companys financial reports that summarizes all of the companys revenues and.

When a Seller receives goods returned from the buyer he prepares and sends a credit note as an intimation to the buyer showing that the money for the related goods is being returned in the form of a credit note. The customer account gets a credit entry and the sales return Sales Return The term sales return is used in payroll journal entry to account for customer returns in the books of account or to account for when a customer returns goods sold owing to defect goods sold or misfit in the customers requirement etc. The profit and loss account starts with gross profit at the credit side and if there is a gross loss it is shown on the debit side.

What is the Reverse Charge MechanismRCM under GST. Link your existing credit debit cards to the app. In the case of a declined debitcredit card your order has not been accepted into our system and will therefore not be charged.

Sample Format of a Debit Note. Please note that we pass on merchant fees for creditdebit card payments. But it will now work even in the inwards direction towards Budapest.

Depending on the purpose of the debit note it can provide information regarding a forthcoming invoice or. Purchases account closed by transferring to debit side of trading and P. The balance goes straight onto one of your existing debit or credit cards.

Related Topic Accounts Payable with Journal Entries Credit Note. A sales return sometimes called a returns inwards is recorded in the accounting records as follows. Profit and Loss Account Format.

Debit Note is an instrument or document which is given by the buyer or purchaser of the goods and services to the seller. Taxpayers who have deducted tax at source must provide the following details in their form. You can alter any information of the ledger master with the except for the closing balance under the group s tock-in-hand.

Enter your details theyll send you a Curve MasterCard - they send to most European addresses including the UK. The global ambitions of both HSBC and Citigroup have been pared back replaced by a narrower focus on core markets. Kidman September 20 Sales SJ01 104400 September 30 Return Inwards RI01 9600 September 30 Balance cd 94800 104400 104400 October 1 Balance bd 94800 B.

Latest Update Ignore prompt on liability for inward supplies attracting reverse charge in Table. Cheque returned charges AED 105 Cheque Return with the code represent after 3 working days AED 105 Total AED 210. Losses Depreciation Return inwards Profit and loss Ac Dr Bad debts etc.

Banton September 13 Sales SJ01 78550 September 24 Return Inwards RI01 16800 September 29 Discount Allowed CB01 6175 29 Cash CB01 55575 78550 78550 Page 03 Page 02 20. Payment of Customs duty andor other taxes may be made in cash Australian dollars creditdebit card MasterCard Visa or American Express or by electronic funds transfer EFTPOS from an Australian bank account. For the year 31st December 2006 Opening stock- 40000 Purchases- 175000 Sales- 303000 Return Inwards- 3000 Return Outwards- 5000 Wages 30000 Carriage Inwards 5000 Closing Stock- 65000.

Credit Note When a customer returns goods purchased on credit heshe also expects some form of confirmation from the seller along with the cancellation of related dues. They are goods which were once sold to external third parties however because of being unsatisfactory they were returned by the customerThey are also called Sales Returns. The debit note is issued by the purchaser against the seller to inform him that the goods or services have been returned and now the seller is debited against the purchaser to the sum of goods and supplies return.

Download the app for iPhone or Android. A credit note is a document sent by a seller to the buyer as a notification to acknowledge that the goods have been registered as return inwards and a credit has been. Return inwards are goods returned to a business by its customers.

Sales Return Bookkeeping Entries Explained. Tax credit that has been received reverted and distributed under CGST SGST and IGST. Part-3 of GSTR 9 Format.

The Reverse Charge Mechanism RCM is the process of GST Payment by the receiver instead of the supplier. Without a ledger you cannot record any transaction. You need to capture the consolidated details of Debit note Credit notes and amendments related to supplies separately only if you choose not to report the net details.

From the bank column on the debit side of the Cash Book. For Pay-on-Delivery orders we recommend paying using Credit cardDebit cardNetbanking via the pay-link sent via SMS at the time of delivery. Sales return account is closed by transfer of balance to sales account.

To Sales return Ac. The balance sheet does not have Debit or Credit Side. The two sides of the balance sheet are called Assets And Liability.

Link your existing credit debit cards to the app. A credit note is sent to inform about the credit. And you can get a Curve card for free.

Now use the Curve MasterCard to buy things online or in person or take cash from ATMs just like a normal. In the return direction it leaves Chişinău on at 1720 arriving Bucharest Gara de Nord at 0617. For example purchase payments sales receipts and others accounts heads are ledger accounts.

Inward returns reduce the total accounts receivable for the business. Total of the Discount column on the debit side of the Cash book. Credit and debit note details.

After which a taxpayer will be able to file outwards and inwards return as well as cumulative monthly returns.

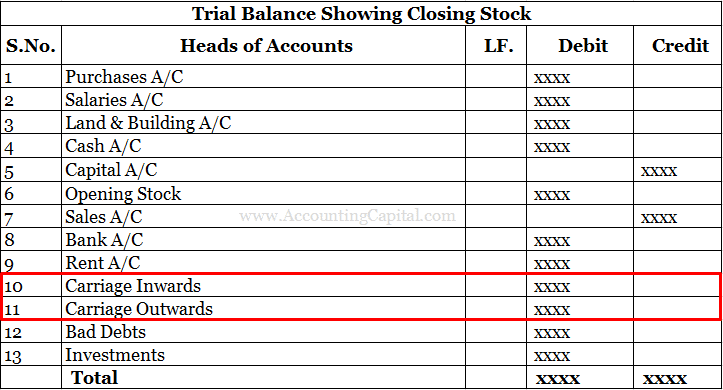

How Is Return Inwards Treated In Trial Balance Accounting Capital

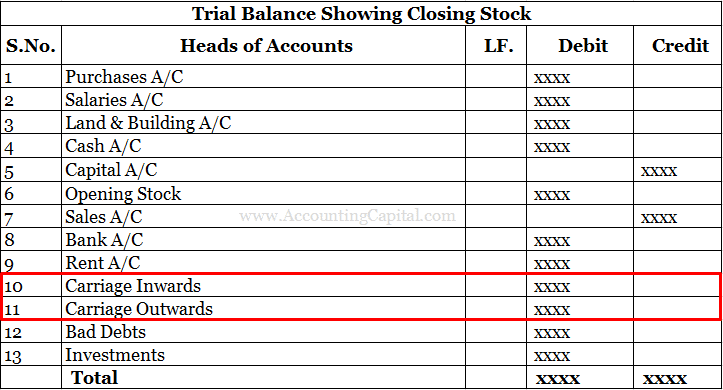

Carriage Outwards Carriage Inwards In Trial Balance Accounting Capital

How Is Return Inwards Treated In Trial Balance Accounting Capital

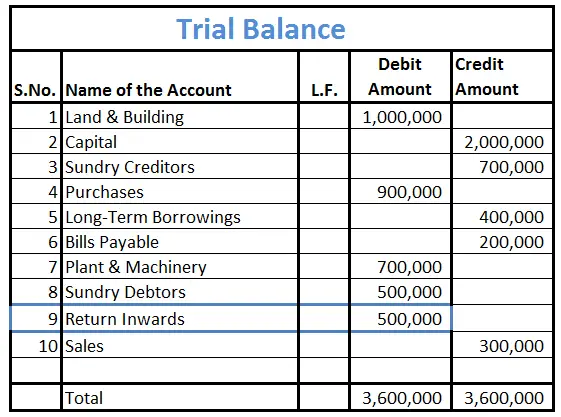

What Are Return Inwards Example Journal Entry Accounting Capital

No comments for "Return Inwards Debit or Credit"

Post a Comment